Geographical Concentration Risk and the Limitations of Postcode Analysis

The traditional approach to assessing geographical concentration risk in banking and property portfolios often relies on postcode, Local Government Area (LGA), or State boundaries. While this method offers a broad view of exposure, it can create misleading results. Properties located near suburb or LGA boundaries are often treated as separate risks, even though they may be only a few hundred meters apart.

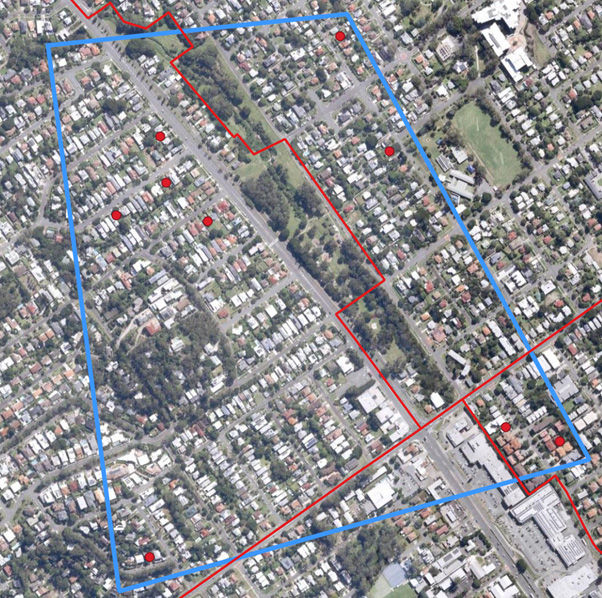

This issue is most visible in high-density inner-city areas, where the bulk of property collateral sits. For example, in Brisbane three different postcodes intersect within a small area (see Image 1). The red dots in the illustration represent individual properties held as collateral by a lender. Under a postcode-based model, these exposures are considered distinct simply because they fall into separate postcodes. In reality, they are part of the same cluster and should be assessed together to give an accurate picture of geographical concentration risk.

By moving beyond postcode or LGA boundaries and adopting a more precise, location-based clustering approach, banks and financial institutions can achieve a more accurate assessment of property risk exposure, especially in urban centres.

Clustering Approach to Geographical Concentration Risk

A more accurate method of assessing geographical concentration risk is to use distance-based clustering rather than postcode or LGA boundaries. This requires each property exposure to be geocoded by assigning latitude and longitude coordinates. With geocoordinates in place, exposures can be grouped based on their physical proximity, measured in meters.

For example, a portfolio could be analysed using a 250-meter minimum distance rule (or another threshold deemed appropriate). Under this method, each property in the cluster must be within 250 m of at least one other property. The cluster continues until no additional properties are located within 250 m, creating a clear grouping of geographically connected exposures. This is illustrated in Image 2, where the area circled in blue represents a cluster.

By adjusting the distance threshold, banks and financial institutions can refine the level of analysis: smaller distances create tighter, more focused clusters, while larger distances provide a broader view of concentration risk.

Alternative Use Cases for Clustering

Alternative Use Cases for ClusteringBeyond measuring geographical concentration risk, distance-based clustering can be applied to a wide range of banking and risk management use cases. For example, properties can be assessed based on their distance to critical points of interest such as shops, businesses, schools, hospitals, or coastlines. Exposures can also be overlaid with natural hazard maps — including flood, bushfire, or cyclone risk zones—to identify clusters of properties that may be highly vulnerable to environmental hazards.

Banks and financial institutions can use this analysis to set risk limits in areas with high concentrations of exposure, particularly where clusters overlap with natural hazards. Clusters can then be compared not only by the number of properties, but also by total portfolio value, insured property valuations, or potential damage costs under different event scenarios (e.g., 1-in-20 year flood, 1-in-50 year flood).

At Climate Mapping Services, we specialise in geospatial statistics, climate risk analysis, and portfolio exposure assessment. By combining Tier 1 data providers with proprietary analytical tools, we deliver accurate, actionable insights into property and portfolio risk.

To learn more or request a free demonstration, contact us at info@climatemappingservices.com.